Your 20s Are a Financial Superpower: How $100/Month Can Grow Over Time

Most people don’t avoid investing because they hate the idea. They avoid it because they think their starting amount is too small to matter.

If you’re in your 20s, that belief can quietly cost you one advantage you can’t buy later: time.

At DollarMiner, our goal is to make money decisions easier with clear math and practical steps (not hype). Below is a simple example you can run yourself in under a minute.

Use the tool here:

https://dollarminer.com/investment-calculator/

Quick note: This is general educational information, not personal financial advice. Investing involves risk, including loss. Taxes and account rules vary by country and can change.

Key takeaways

- Starting early can matter more than starting big.

- Small monthly contributions can become meaningful when they stay invested for decades.

- The final result depends on returns, fees, taxes, and consistency.

- The best plan is the one you can keep doing.

A short story people repeat (without realizing it)

Many people genuinely want to invest, but life is expensive. Rent is high. Food costs more than it used to. The budget feels tight.

So they tell themselves a reasonable lie:

“I’ll start when I can do it properly.”

“Properly” becomes $500/month. Or $1,000/month. Or “after the next raise.” Or “when things calm down.”

Things rarely calm down.

What actually works is starting with what’s realistic now, then building up later.

A realistic example: $100 per month starting at 20

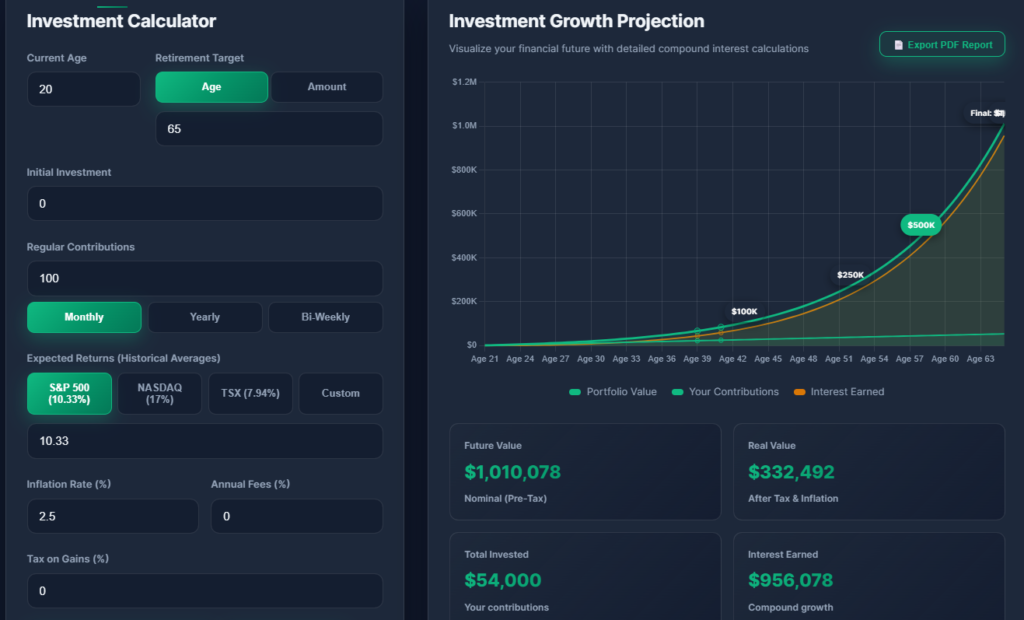

Using the DollarMiner Investment Calculator, here’s a clean scenario that mirrors how many beginners start.

Assumptions used in this example:

- Starting age: 20

- Target age: 65

- Starting amount: $0

- Contribution: $100/month

- Return assumption: 10.33% (S&P 500 preset in the tool)

- Inflation assumption: 2.5%

- Fees: 0% (to keep the math simple)

- Tax on gains: 0% (because taxes depend on your country/account type)

What the calculator shows under those assumptions (example output):

- Future value (nominal): ~$1,010,078

- Total contributed: $54,000

- Growth in the projection: ~$956,078

- Inflation-adjusted value (real value): ~$332,492

Two important reminders:

- Markets don’t deliver the same returns every year. This is an example, not a promise.

- Fees and taxes are real in life. Run your own scenario with realistic inputs.

Run your version here:

https://dollarminer.com/investment-calculator/

A smart way to test it:

- Run a conservative return

- Run a middle return

- Run an optimistic return

That gives you a range instead of a fantasy.

Why your 20s matter more than your starting amount

Compounding is not impressive at the beginning. It often looks slow early, then accelerates later.

That’s the point.

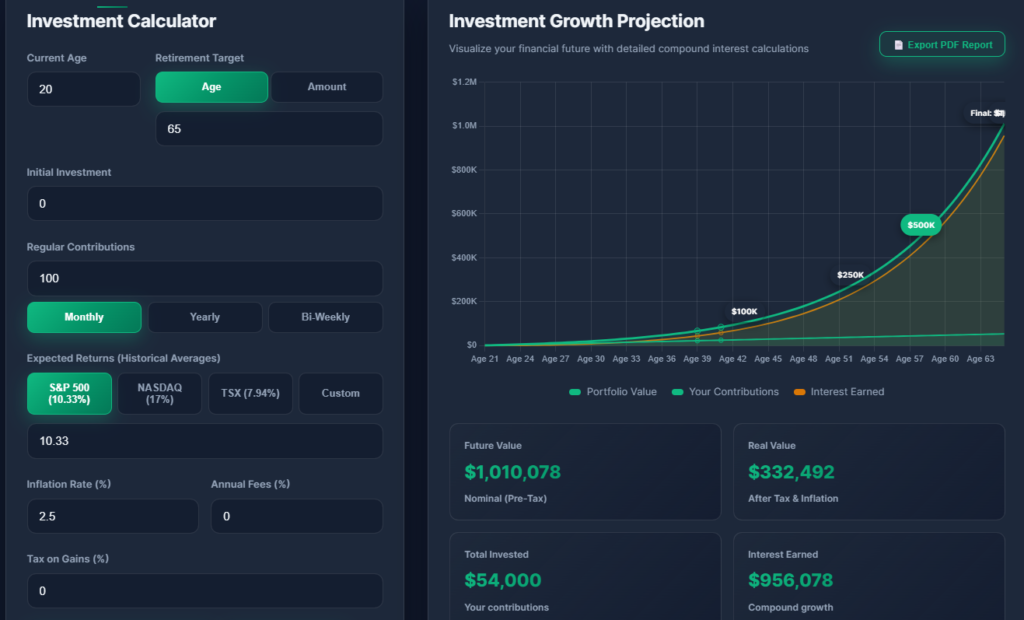

We ran the same scenario twice and changed only one thing: the start age, 20 versus 30. We kept the monthly contribution, assumptions, and end age the same.

Start at 20: $100/month example projection from the DollarMiner Investment Calculator.

Start at 30: Same $100/month assumptions, starting 10 years later (projection).

Your 20s give compounding more runway. Your earliest contributions get the most time to grow.

This is why small contributions started early can beat larger contributions started later.

What actually drives your outcome

Returns matter, but in real life these three factors often matter more.

Consistency

A plan you follow beats a perfect plan you quit. If your plan is too complex, you’ll eventually stop.

Fees

Fees reduce your growth quietly. Over decades, even small percentages can make a meaningful difference.

Your behavior during down markets

Markets will drop at some point. The most common long-term mistake isn’t picking the “wrong” investment—it’s abandoning the plan when fear shows up.

A good plan assumes you’ll feel uncomfortable sometimes.

Where should $100 per month go?

This isn’t a “buy this exact thing” article. The right choice depends on your timeline and risk tolerance.

If your goal is 10+ years away

Many long-term investors choose diversified, low-cost funds/ETFs so they’re not betting everything on one stock or one idea.

If you might need the money soon

Short timelines and high volatility can clash. If you need the money in a few years, you may want a more conservative approach.

Taxes and account rules

Account rules vary by country (and change over time). Always verify what applies to you.

A simple plan you can actually follow

Here’s a beginner-friendly framework that works because it’s realistic.

Step 1: Automate the $100/month

Automation beats motivation. If you rely on willpower, you’ll miss months. If it’s automatic, the habit runs in the background.

Step 2: Keep the investment choice simple

Simplicity is stability. You want a setup that’s easy to maintain and hard to sabotage.

Step 3: Decide your “down market rule” now

This is the part most people skip—and it’s why they quit.

A reasonable rule set:

- Don’t change your long-term plan based on headlines.

- Don’t sell long-term investments just because the market is down.

- If income drops, pause contributions first and reassess—don’t panic sell.

Decision guide: what should you do today?

| Your situation | Best next move | Why it helps |

|---|---|---|

| No emergency buffer | Build a starter emergency fund | Prevents panic selling later |

| High-interest debt | Pay it down first, then invest | It’s a guaranteed drag on returns |

| 10+ year timeline | Automate diversified investing | Gives compounding time to work |

| You tend to overthink | Pick a simple plan for 12 months | Consistency beats constant tweaking |

FAQ

Is $100 per month really enough?

Over decades, it can be. The early years often look slow, then compounding accelerates later.

Is the “$1M” outcome guaranteed?

No. It’s an example under assumptions. Real returns vary, and fees/taxes can change outcomes.

What return should I assume?

Test a range. If you want to be conservative, use a lower assumption and see if the plan still works.

Why does the inflation-adjusted number look much lower?

Because purchasing power changes over time. Inflation-adjusted values keep expectations realistic.

Should I invest or pay off debt first?

It depends on your interest rate and cash flow stability. High-interest debt often deserves priority because paying it down is a “guaranteed return” equal to the interest rate.

What if the market drops after I start?

That can happen. A long-term plan assumes volatility. The biggest mistake is usually panic selling.

Closing: the real superpower is starting while time is cheap

The headline is attention-grabbing. The real message is practical:

In your 20s, time is still cheap. You don’t need to invest perfectly to benefit from it. You just need to start with a simple system you can maintain.

If you want to make this real today, run your numbers and test conservative vs optimistic assumptions:

https://dollarminer.com/investment-calculator/